Daily Newsletter Oct 18 '22

MyntBit's Daily Newsletter is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - None - alerts will be provided in Discord

Today's Recap

Market Snapshot

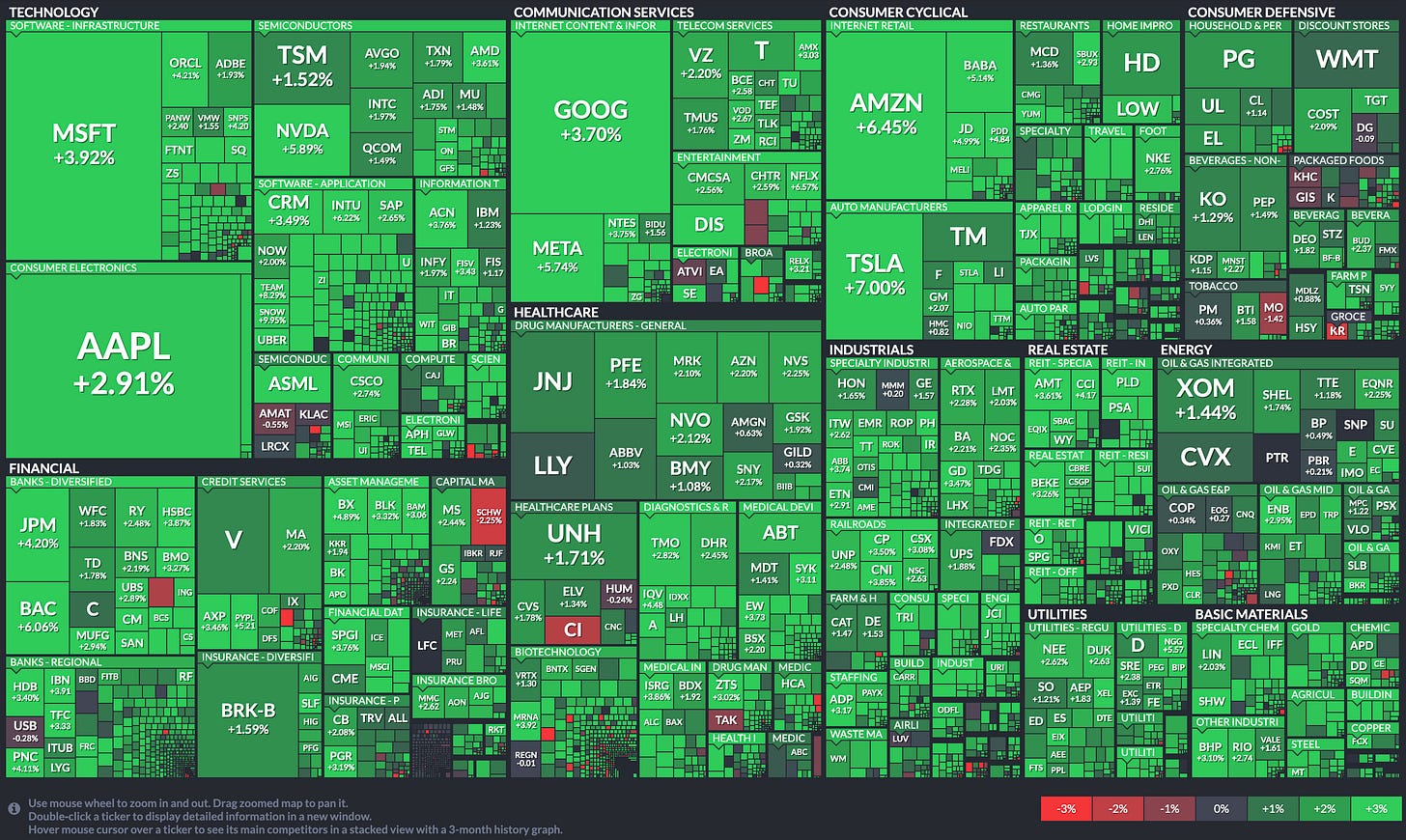

Market Heatmap

Sector Heatmap

Market Recap

The stock market started the week with a nice rally after a big sell off on Friday. The major averages logged sizable gains thanks to broad buying efforts.

The positive disposition today was thanks in part to UK Finance Minister Hunt scrapping most of the tax measures from the prior "mini-budget," which led to a rally in the gilt market and British pound. The 10-yr gilt yield fell 42 basis points to 3.97% and the pound surged (GBP/USD +1.5% to 1.1351).

Other tailwinds for stocks today included better-than-expected Q3 earnings from Bank of America (BAC 33.62, +1.92, +6.1%) and Morgan Stanley Chief Strategist Mike Wilson, who has been right this year with his bear market call, saying the S&P 500 could potentially get to 4,150 in a technical rally in the short term if an earnings capitulation or recession can be avoided.

Many stocks moved higher today with the advance-decline line favoring advancing issues by a greater than 4-to-1 margin at the NYSE and a greater than 2-to-1 margin at the Nasdaq.

Gains in mega cap stocks boosted index level performance. The Vanguard Mega Cap Growth ETF (MGK) closed up 3.5% versus a 2.2% gain in the Invesco S&P 500 Equal Weight ETF (RSP) and a 2.7% gain in the S&P 500. Apple (AAPL 142.41, +4.03, +2.9%) was a key mover after Morgan Stanley named it a top pick in the event of an economic downswing.

All 11 S&P 500 sectors closed in the green with consumer discretionary (+4.2%) showing the biggest gain. That move was bolstered by constructive comments on the state of the consumer from Bank of America following its earnings report. Consumer staples (+1.1%) and energy (+1.2%) brought up the rear.

WTI crude oil futures fell 0.3% today to $85.49/bbl. Natural gas futures fell 7.7% to $5.99/mmbtu.

Buyers in the equity market were not deterred when the 10-yr Treasury note yield breached 4.00%. The 10-yr note yield dropped to 3.91% earlier but settled up one basis point to 4.02%. The 2-yr note yield, which hit 4.40% earlier, settled at 4.43%.

Ahead of Tuesday's open, Johnson & Johnson (JNJ), Albertsons (ACI), Lockheed Martin (LMT), Goldman Sachs (GS), Truist (TFC), and Hasbro (HAS) headline the earnings reports.

Market participants will receive the following economic data on Tuesday:

9:15 ET: September Industrial Production (Briefing.com consensus 0.1%; prior -0.2%) and Capacity Utilization (Briefing.com consensus 79.9%; prior 80.0%)

10:00 ET: October NAHB Housing Market Index (Briefing.com consensus 44; prior 46)

16:00 ET: August Net Long-Term TIC Flows (prior $21.40 bln)

Economic data was limited to the October Empire State Manufacturing Survey, which came in at -9.1 versus the prior reading of -1.5. A number below 0.0 is indicative of a contraction in manufacturing activity in the New York Fed region.

Dow Jones Industrial Average: -16.9% YTD

S&P Midcap 400: -18.8% YTD

S&P 500: -22.8% YTD

Russell 2000: -22.7% YTD

Nasdaq Composite: -31.8% YTD

source: briefing.com

Market Trader by MyntBit

Market Trader Edition No. 9

Earnings Calendar

Economic Calendar

Keep reading with a 7-day free trial

Subscribe to BitResearch by MyntBit to keep reading this post and get 7 days of free access to the full post archives.