Daily Newsletter Oct 20 '22

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - $COIN | $JD - Details will be provided in Discord

Today's Recap

Market Snapshot

Market Heatmap

Sector Heatmap

Market Recap

Today's trade was somewhat choppy. The major averages spent some time in positive territory this morning, but were in the red most of the session, ultimately closing off session lows. Price action for equities was driven by price action in the Treasury market as yields lifted to fresh highs for the year.

The 10-yr note yield rose 13 basis points to 4.13%, its highest level since 2008, and the 2-yr note yield rose 12 basis points to 4.56%. These moves followed an admission late yesterday by Minneapolis Fed President Kashkari (2023 FOMC voter) that he could argue for the fed funds rate to go above 4.75% if he doesn't see any improvement in underlying or core inflation.

Earnings since yesterday's close were generally better than expected, but were not able to offset the concerns about rising interest rates. Netflix (NLFX 272.38, +31.52, +13.1%), Travelers (TRV 174.17, +7.40, +4.4%), United Airlines (UAL 39.10, +1.85, +5.0%), and ASML (ASML 424.02, +25.03, +6.3%) were among the more notable standouts closing with sizable price gains after reporting quarterly results.

Rising oil prices also kept pressure on investors' sentiment. WTI crude oil futures rose 2.6% to $84.38/bbl following an announcement that President Biden is authorizing the release of an additional 15 million barrels from the Strategic Petroleum Reserve for December delivery.

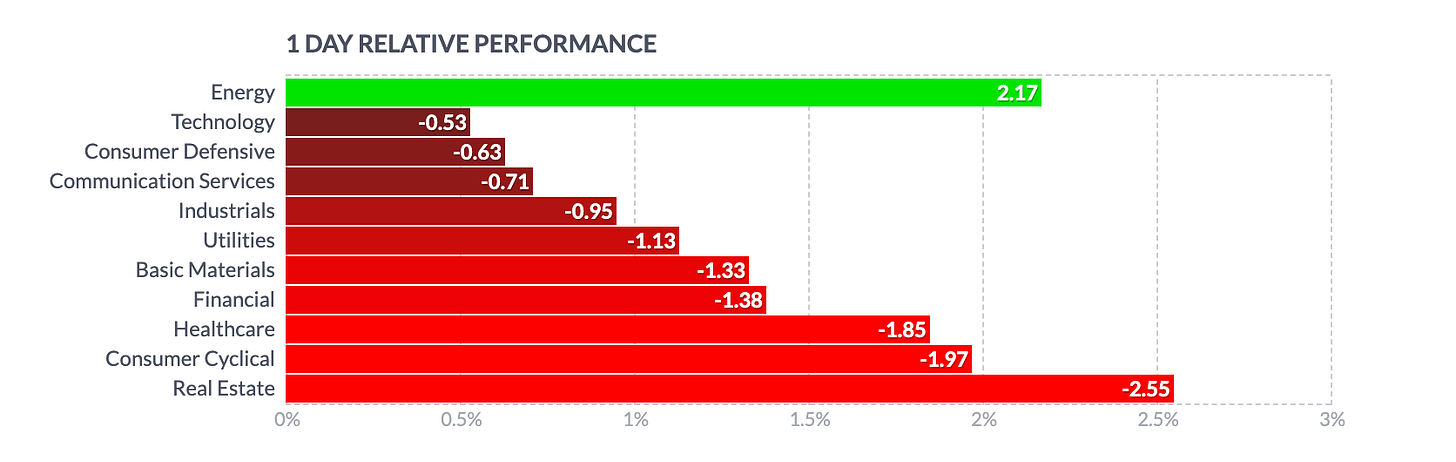

The move in oil prices boosted energy stocks, leaving the S&P 500 energy sector (+2.9%) alone in positive territory by the close. Sector component Baker Hughes (BKR 25.65, +1.47, +6.1%) was the best performer with a big earnings-driven gain. Exxon Mobil (XOM 103.79, +2.99, +3.0%) was another standout for the group after it was upgraded to Buy from Hold at Jefferies

The remaining ten sectors all logged losses on the day. The information technology sector (-0.3%) exhibited a slimmer loss than the S&P 500 (-0.7%) thanks to some relative strength in the semiconductor space. The PHLX Semiconductor Index closed up 0.8%.

Market participants received the Fed Beige Book today, which showed that employment and economic activity remained strong, but varied, across Districts. The report also showed that outlooks grew more pessimistic amid growing concerns about weakening demand.

Ericsson (ERIC), AT&T (T), American Airlines (AAL), Dow (DOW), Nucor (NUE), and Freeport-McMoRan (FCX) are set to report earnings ahead of Thursday's open.

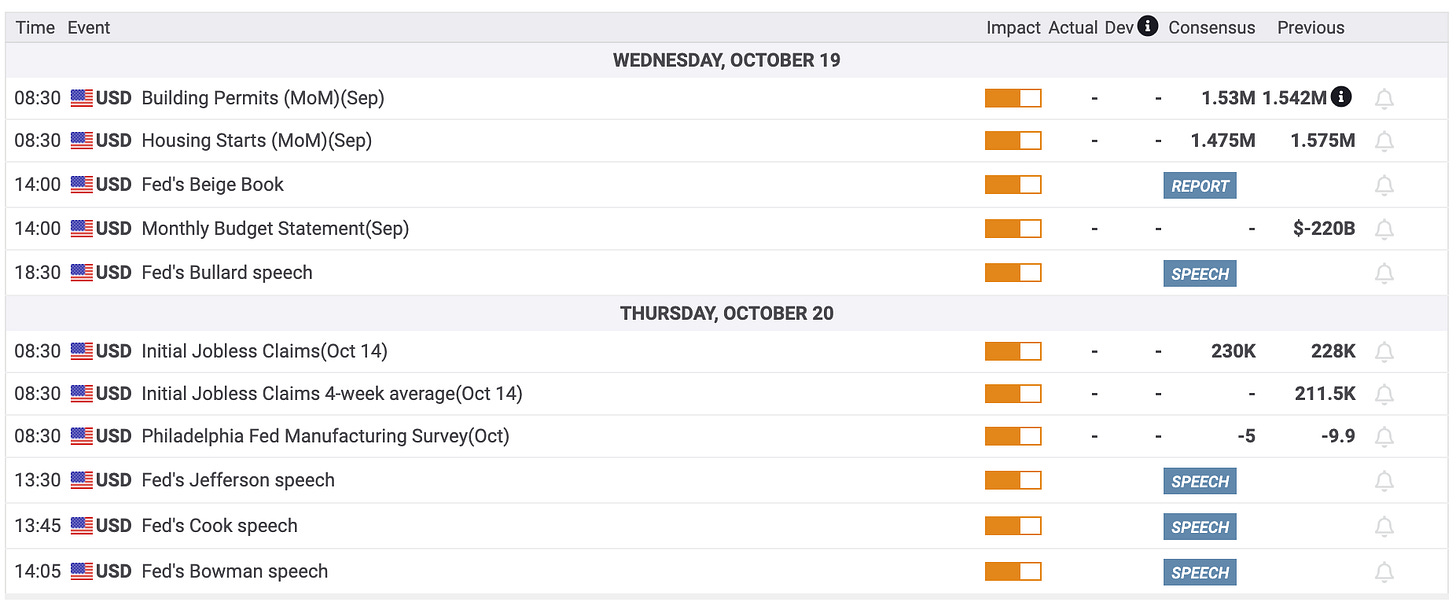

Looking ahead to Thursday, market participants will receive the following economic data:

8:30 ET: Weekly Initial Claims (Briefing.com consensus 233,000; prior 228,000), Continuing Claims (prior 1.368 mln), and October Philadelphia Fed survey (Briefing.com consensus -5.0; prior -9.9)

10:00 ET: September Leading Indicators (Briefing.com consensus -0.3%; prior -0.3%) and September Existing Home Sales (Briefing.com consensus 4.70 mln; prior 4.80 mln)

10:30 ET: Weekly natural gas inventories (prior +125 bcf)

Reviewing today's economic data:

Weekly MBA Mortgage Application Index declined 4.5% after a 2.0% decline

Total housing starts declined 8.1% month-over-month in September to a seasonally adjusted annual rate of 1.439 million units (Briefing.com consensus 1.465 million). Building permits rose 1.4% month-over-month to 1.564 million (Briefing.com consensus 1.550 million).

The key takeaway from the report is that there was ongoing weakness in starts and permits for single-family units, which were down 4.7% and 3.1% month-over-month, respectively. The downturn corroborates the adverse impact sharply higher mortgage rates have had on buyer demand and builder sentiment.

Weekly EIA Crude Oil Inventories showed a draw of 1.73 million barrels versus a build of 9.88 million last week

Dow Jones Industrial Average: -16.3% YTD

S&P Midcap 400: -19.1% YTD

S&P 500: -22.5% YTD

Russell 2000: -23.1% YTD

Nasdaq Composite: -31.7% YTD

source: briefing.com