Market Trader Report | Jun 16, 2024 + Stock Watchlist

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 24

The major U.S. large-cap equity indices mostly ended higher this week, with a significant turning point on Wednesday. The initial boost came from a slowdown in Consumer Price Index (CPI) inflation, which positively impacted the markets. However, the Federal Reserve's widely anticipated decision to keep the federal funds rate unchanged at 5.25% – 5.50% led to a slight pullback. The Fed also released an updated Summary of Economic Projections, indicating that the median target range for the federal funds rate now suggests just one rate cut this year.

The Producer Price Index (PPI), released on Thursday, added to the positive outlook by showing further signs of slowing inflation. Meanwhile, small business optimism improved despite ongoing uncertainty, while consumer sentiment unexpectedly declined, reflecting pressure on consumers' perceptions of current conditions.

Looking ahead to next week, the focus will be on retail sales and S&P Global’s Purchasing Managers’ Indexes (PMIs) for manufacturing and services. Other key data releases will include updates on the housing market, industrial production, and leading economic indicators.

Weekly Market Review

The S&P 500 and Nasdaq Composite reached new record highs this week, closing up 1.6% and 3.2%, respectively. However, other major indices saw declines, with the Dow Jones Industrial Average down 0.5% and the Russell 2000 falling by 1.0%.

The gains in mega-cap stocks were crucial for the index-level increases in the S&P 500 and Nasdaq. In contrast, the equal-weighted S&P 500 fell 0.5% for the week.

The Vanguard Mega Cap Growth ETF (MGK) jumped 3.4%, driven by notable performances in key stocks. Apple (AAPL) surged 7.9%, hitting record highs after unveiling "Apple Intelligence," a personal intelligence system for iPhone, iPad, and Mac, at its Worldwide Developers Conference.

Broadcom (AVGO) was another top-performing mega-cap, soaring 23.4% following a better-than-expected earnings report, positive outlook, and the announcement of a 10-for-1 stock split.

Adobe (ADBE) also delivered impressive earnings and guidance, gaining 12.9% this week.

These strong performances propelled the S&P 500 information technology sector to a 6.4% gain, the highest among sectors. The real estate sector followed with a 1.2% gain. Conversely, the energy sector declined by 2.3%, and the financial sector fell by 2.0%, marking the biggest losses.

The underlying bearish trend that led to the decline in the equal-weighted S&P 500 was due to normal consolidation after a substantial rally in many stocks. Meanwhile, mega-caps benefited from the positive corporate news and a significant drop in market rates.

The 10-year note yield fell by 22 basis points, and the 2-year note yield declined by 20 basis points to 4.69%. This movement was in response to the week’s bond auctions, including a lackluster $58 billion 3-year note sale, a robust $39 billion 10-year note sale, and a solid $22 billion 30-year bond reopening.

Treasury activity was also influenced by favorable inflation data. The May Consumer Price Index (CPI) showed welcome disinflation on a year-over-year basis, with the total CPI rising by 3.3% compared to 3.4% previously, and the core CPI increasing by 3.4% compared to 3.6%. The May Producer Price Index (PPI) indicated a 0.2% month-over-month decline in total PPI, while the core PPI remained unchanged from the previous month.

The market also reacted to the Federal Reserve's latest decision. The Federal Open Market Committee (FOMC) left the target range for the federal funds rate unchanged at 5.25-5.50%, as anticipated. The decision was unanimous and reiterated that "The Committee does not expect it will be appropriate to reduce the target range until it has greater confidence that inflation is moving sustainably toward 2 percent."

The surprise came from the Summary of Economic Projections (SEP), which projected only one rate cut this year, down from three in March's projections. Fed Chair Powell's press conference presented a non-committal stance on future policy.

As a result of these developments, expectations for a rate cut increased. The fed funds futures market now indicates a 70.2% probability of a 25 basis point rate cut at the September FOMC meeting, up from 50.5% a week ago, according to the CME FedWatch Tool.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The highlight of the holiday-shortened week will be the preliminary release of S&P Global’s June manufacturing and service PMIs on Friday. Key economic data also includes updates on retail sales and industrial production for May, the Index of Leading Economic Indicators, and June regional business surveys from the New York and Philadelphia Fed districts. Additionally, there will be a series of housing market reports, covering housing starts, building permits, existing home sales, and homebuilder sentiment.

In the auction space, the U.S. Treasury Department will issue $34 billion in 20-year bonds and 5-year Treasury Inflation-Protected Securities (TIPS).

In China, the focus will be on industrial production, retail sales, fixed asset investment, and property investment, as well as updates on the one-year medium-term lending facility rate and the one- and five-year loan prime rates.

Japan will release preliminary June Jibun Bank PMIs, along with updates on the national CPI, core machine orders, and the trade balance. The Reserve Bank of Australia will hold a policy meeting, and economic data from the country includes preliminary June PMIs. Additionally, South Korea’s May Producer Price Index (PPI) will be released.

In Europe, the focus will be on the first release of June PMIs, consumer confidence, finalized May CPIs, and June’s ZEW expectations for economic growth. The Bank of England will hold a policy meeting on Thursday, with British data releases including the CPI, the companion Retail Price Index, retail sales, and house prices. Germany will release its PPI and the ZEW index of current conditions, while France will provide updates on manufacturing confidence and retail sales.

Important Economical & Earnings Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

Short-term: Cautiously bullish, watching for a breakout above $544.12 with a target above $545.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

QQQ - Invesco QQQ Trust Series 1

Short-term: Cautiously bullish, watching for a breakout above $479.26 with a target above $480.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

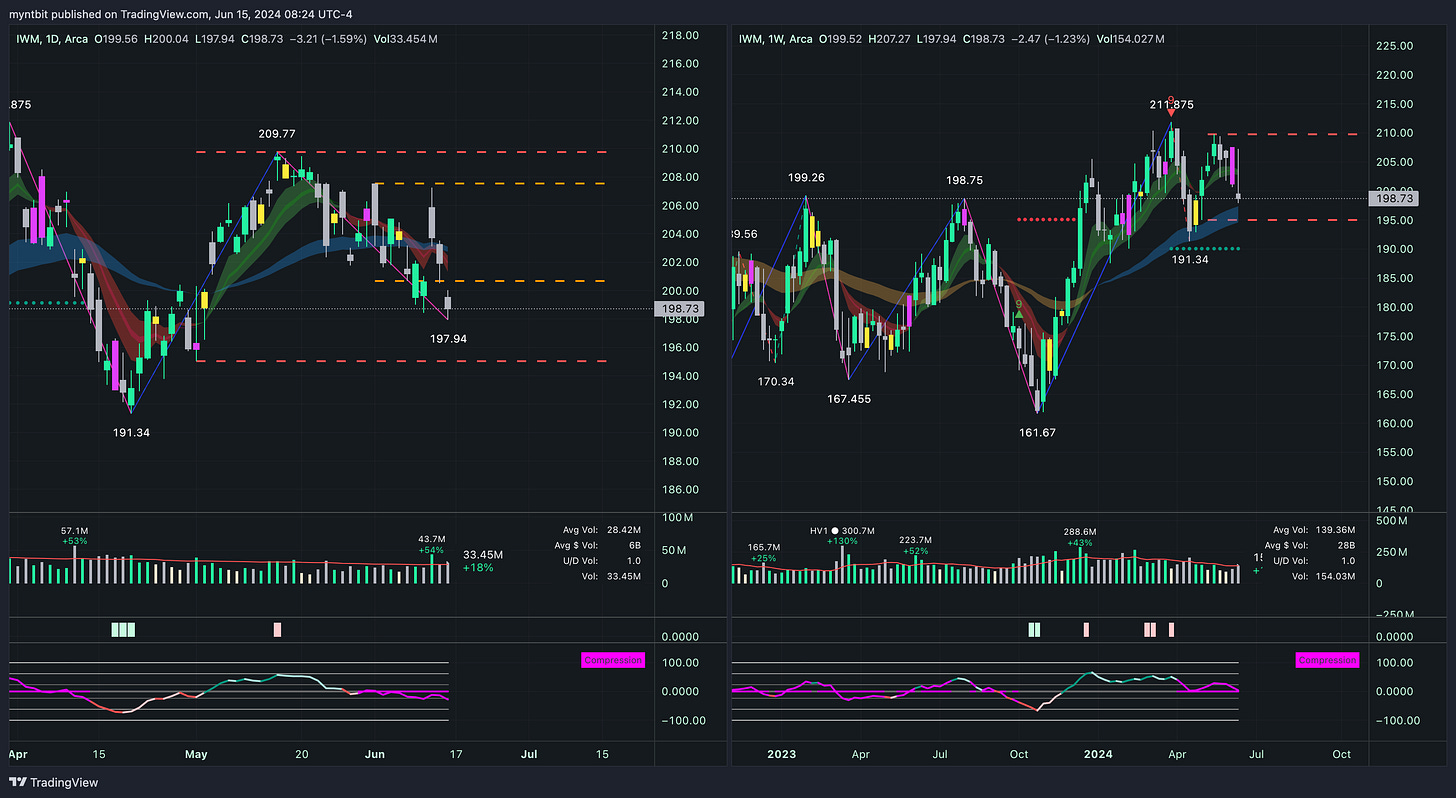

IWM - iShares Russell 2000 ETF

Short-term: Neutral to cautiously bullish, with a focus on maintaining above $197.94 and targeting $209.77.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

DIA - SPDR Dow Jones Industrial Average ETF Trust

Short-term: Neutral to cautiously bullish, watching for a breakout from the symmetrical triangle and targeting $390.18.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

VIX - Volatility S&P 500 Index

Short-term: Neutral to cautiously bullish, with a watch on the support and resistance levels for potential breakout indicators.

Medium-term: Neutral, monitoring for any significant changes that could indicate increased market volatility.

Long-term: Bearish on volatility, unless market conditions change drastically, leading to increased uncertainty.

Last Week's Watchlist

JPM - JPMorgan Chase & Co.

JPM finally broke down and hit our downside target. Will be removed from the list.

MRNA - Moderna Inc

MRNA is still consolidating and remains within the range created in May.

GE - General Electric Co

GE finally broke down from the range and hit our downside target. Will be removed from the list.

CRM - Salesforce Inc

CRM rejected the critical zone at 240s and came down to test 228 support.

QCOM - Qualcomm Inc

QCOM ended up creating a new all-time high. Will be removed from the list.

PANW - Palo Alto Networks Inc

PANW recovered and reached our upside target at 324. Will be removed from the list.

Stock Watchlist

COIN - Coinbase Global Inc

Bullish Case: If the stock breaks above the $263.80 resistance level, it may test the next resistance at $274.06. The symmetrical triangle suggests potential for a breakout.

Bearish Case: A break below the $234.12 support level could lead to a decline towards $219.17, continuing the bearish trend.

VRT - Vertiv Holdings Co

Bullish Case: If the stock can hold above the $85.14 support level, it may rally towards the $98.39 resistance level. The RSI nearing oversold conditions supports a potential short-term bounce.

Bearish Case: A break below $85.14 could lead to a decline towards $77.16, continuing the bearish trend indicated by the descending channel.

DELL - Dell Inc.

Bullish Case: If the stock can maintain above the $127.59 support level, it could potentially rally toward the $144.80 resistance. The oversold RSI supports a possible short-term bounce.

Bearish Case: A break below $127.59 could lead to a further decline towards $114.25.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWhispers, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.