Market Triangle

A proprietary model that evaluates the current state of the market using three core components — Trend, Breadth, and Momentum.

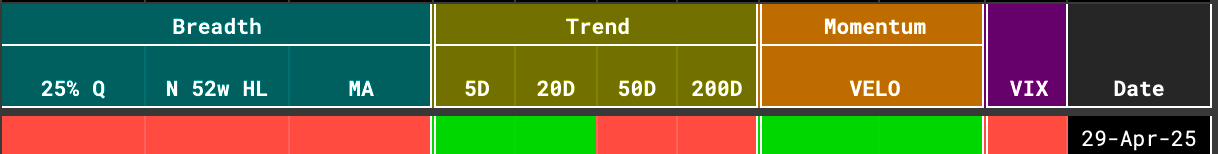

April 29, 2025

⦿ Trend: Short-term positive, long-term negative

⦿ Breadth: Negative

⦿ Momentum: Positive but high volatility

The market is showing conflicting signals — momentum is improving in a volatile environment, but weak breadth and a split trend suggest caution, with new positions favored only on strong confirmation or pullback strength.

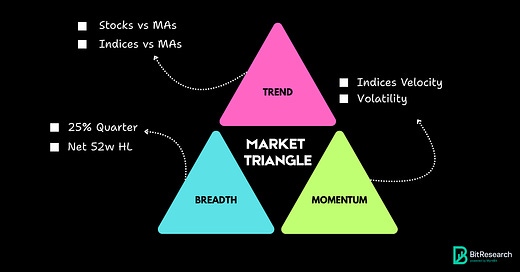

How to Read the Market Triangle?

The Market Triangle is a core analytical model used by BitResearch to assess overall market health and guide our swing trading strategy. Rather than predict direction, the Market Triangle reflects the current state of the market across three key dimensions. It is designed to be used alongside your portfolio performance, watchlist signals, and broader market context.

Trend

The Trend metric reflects the strength and direction of the market's prevailing movement. It is derived by comparing:

The number of stocks vs. their moving averages (MAs)

The number of indices above their key moving averages

A strong trend indicates institutional support and directional alignment across sectors.

Breadth

Breadth measures market participation and expansion. A healthy uptrend is supported by wide participation across different stocks and industries. We assess breadth using:

% of stocks gaining 25% or more in the last quarter

Net number of 52-week highs minus lows

This reveals whether market rallies are broad-based or narrow.

Momentum

Momentum captures the velocity of price movement and the overall volatility environment. It’s driven by:

Short-term index rate-of-change

Measures of market volatility

Momentum helps identify phases of acceleration, exhaustion, or reversals in price action.

Note: The Market Triangle does not forecast future direction — it serves as a diagnostic tool to assess the market’s present condition. Use it in conjunction with your portfolio feedback, BitPicks trigger data, and an awareness of the current market cycle.