Weekly Report | Sep 01, 2024 + NFLX, TTD & AMZN

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit | Issue# 32

Stocks fluctuated throughout the week and are on track to close lower despite encouraging economic data, particularly regarding personal consumption expenditures (PCE) inflation. While the market's focus has shifted to the labor market as inflation continues to move in the right direction, the data still supported expectations for a September rate cut. Additionally, the second estimate of second-quarter gross domestic product (GDP) was revised upward, mainly due to stronger consumer spending, and consumer confidence also saw improvement. However, pending home sales delivered a significant downside surprise, highlighting the restrictive impact of still-elevated interest rates.

Overall Stock Market Heatmap

Sector Performance

Looking Ahead to the Upcoming Week

Looking ahead to next week, investors will be closely monitoring the August jobs report, which will provide some of the most critical economic data leading up to the Federal Open Market Committee’s meeting. This will be complemented by several labor-market updates throughout the week, as well as the Institute for Supply Management (ISM) Purchasing Managers’ Index (PMI) for manufacturing and services, factory orders, and construction spending data.

Economic Events

Earnings Event

Markets

Below are the levels for the upcoming week. Updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

Short Term (1-2 weeks): Bullish. Watch for a break above $565, targeting $575.

Medium Term (1-3 months): Bullish. The trend is likely to continue upwards towards $600 if the price holds above $550.

Long Term (3+ months): Bullish. The long-term uptrend remains intact, with potential upside towards $600 and beyond.

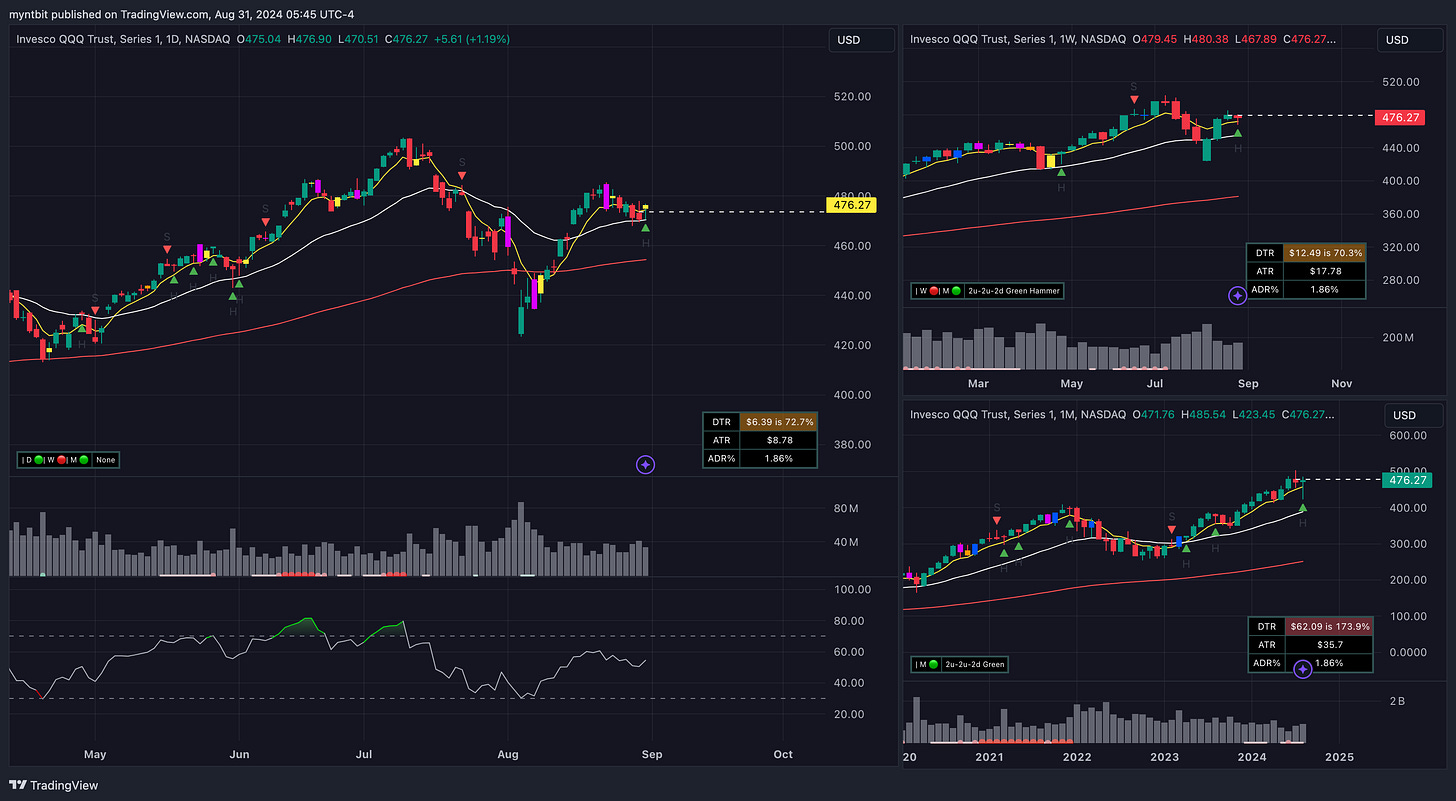

QQQ - Invesco QQQ Trust Series 1

Short Term (1-2 weeks): Bullish. Watch for a break above $480, targeting $490 and potentially $500.

Medium Term (1-3 months): Bullish. The trend is likely to continue upwards towards $520 if the price holds above $460.

Long Term (3+ months): Bullish. The long-term uptrend remains intact, with potential upside towards $540 and beyond.

IWM - iShares Russell 2000 ETF

Short Term (1-2 weeks): Bullish. Watch for a break above $220, targeting $225 and potentially $230.

Medium Term (1-3 months): Bullish. The trend is likely to continue upwards towards $230-$240 if the price holds above $210.

Long Term (3+ months): Bullish. The long-term uptrend remains intact, with a potential upside towards $240 and beyond.

DIA - SPDR Dow Jones Industrial Average ETF Trust

Short Term (1-2 weeks): Bullish. Watch for a break above $416, targeting $420 and potentially $430.

Medium Term (1-3 months): Bullish. The trend is likely to continue upwards towards $430-$440 if the price holds above $410.

Long Term (3+ months): Bullish. The long-term uptrend remains intact, with potential upside towards $450 and beyond.

VIX - Volatility S&P 500 Index

Short Term (1-2 weeks): Bearish. Expect the VIX to potentially decline towards $14.50, with a possible break to $13.00.

Medium Term (1-3 months): Bearish. The VIX may remain low, testing historical lows around $13.00 or even $12.00.

Long Term (3+ months): Bearish. Continued stability in the broader market could keep the VIX suppressed unless a significant market event occurs.

Stock Watchlist for the Upcoming Week

NFLX - Netflix, Inc. (Freebie)

Bullish Case:

Short-term (1-2 weeks): Netflix could continue to rally towards the $726.44 resistance level. A break above this level would confirm the continuation of the uptrend.

Medium-term (1-3 months): If Netflix sustains above $700, the stock could target the next major resistance at $750 or higher, driven by bullish momentum.

Long-term (3+ months): The long-term trend remains strongly bullish, with the potential to reach $800 or more, provided the current trend continues.

Bearish Case:

Short-term: If Netflix fails to hold above $700, it could retest the support levels at $677.10 or $648.70.

Medium-term: A break below $648.70 could signal a more significant correction, potentially targeting $600.

Long-term: A sustained break below $600 could challenge the long-term bullish trend, with potential downside to $550 or lower.

Options Opportunity

Call Option: Consider buying calls if Netflix sustains above $700, with a target of $726.44 or higher.

Put Option: If the stock fails to hold above $700 and breaks below $677.10, consider buying puts with a target of $648.70 or lower.

Keep reading with a 7-day free trial

Subscribe to BitResearch by MyntBit to keep reading this post and get 7 days of free access to the full post archives.