Market Triangle | 05.15.2025

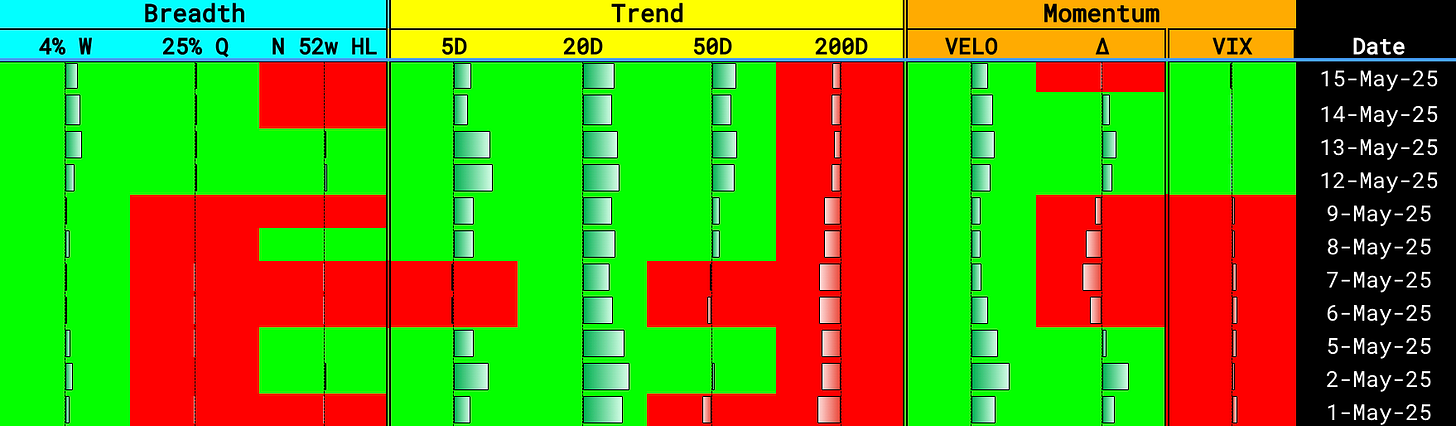

A proprietary model that evaluates the current state of the market using three core components — Trend, Breadth, and Momentum.

⦿ Trend → Short- and medium-term trend strength continues to support bullish setups, but the 200-day trend remains neutral to negative, reflecting lingering macro uncertainty.

Short-term (5D) → Positive

Medium-term (20D & 50D) → Positive

Long-term (200D) → Still Negative

⦿ Breadth → While breadth was supportive earlier in the week, fewer stocks are pushing to new highs. This drop in NHLs reflects narrowing participation beneath the surface, a typical sign of short-term fatigue or rotation.

4% Week → Positive

25% Quarter → Positive

52w New High/Low (NHL) → Negative

⦿ Momentum → Momentum is still net constructive, but the velocity indicator has started to fade. This slowing rate of change, combined with stable volatility, suggests a market that is pausing rather than reversing — but one that requires more selective positioning.

Velocity → Positive but slowing

Volatility (VIX) → Positive (low and declining)

The market continues to offer a technically supportive backdrop with stable trends and low volatility, but the internals are flashing caution. Breadth is narrowing and momentum is decelerating, indicating the rally may be losing energy. Selective long exposure remains favored, but with tighter stops and a focus on relative strength leaders.

Broader Market Analysis

Market tone remains healthy with broad sector participation and large-cap leadership (Tech, Financials, Industrials). Rotation is evident into both defensive (Utilities) and economically sensitive sectors (Industrials). However, discretionary spending and speculative assets (IBIT, XLY) are showing fatigue, and breadth is selectively thinning — particularly among small and mid caps.

This is a constructive tape for tactical bullish exposure, but selective positioning remains key. Favor trend-confirmed leaders over choppy or lagging names.

Ready to Trade Smarter? Join BitResearch Premium

BitResearch isn’t just a stock alert service — it’s your edge in today’s market. With access to our live portfolio, you’ll receive expertly curated trade setups, complete with clear entry points, dynamic stop-losses, and two-stage profit targets.

Whether you're risk-averse or growth-focused, our menu of high-probability ideas is built to fit your strategy — all backed by a 14-factor technical model used by serious traders.

✅ Real trades. Real-time updates.

✅ BitReports with actionable insights

✅ No hype. No day trading. Just data-driven swing trades.

🎯 Start your 7-day free trial today and get instant access to the full portfolio, without obligation.

Let BitResearch simplify your trading — so you can focus on results.

Stay Connected — Follow BitResearch

Want even more insights, trade ideas, and market breakdowns?

📲 Follow us on Twitter/X

📬 Subscribe on YouTube for tutorials and portfolio updates

📣 Join our growing community of traders sharing strategies and results

At BitResearch, we’re building more than trades — we’re building smarter investors.