Market Triangle | 05.20.2025

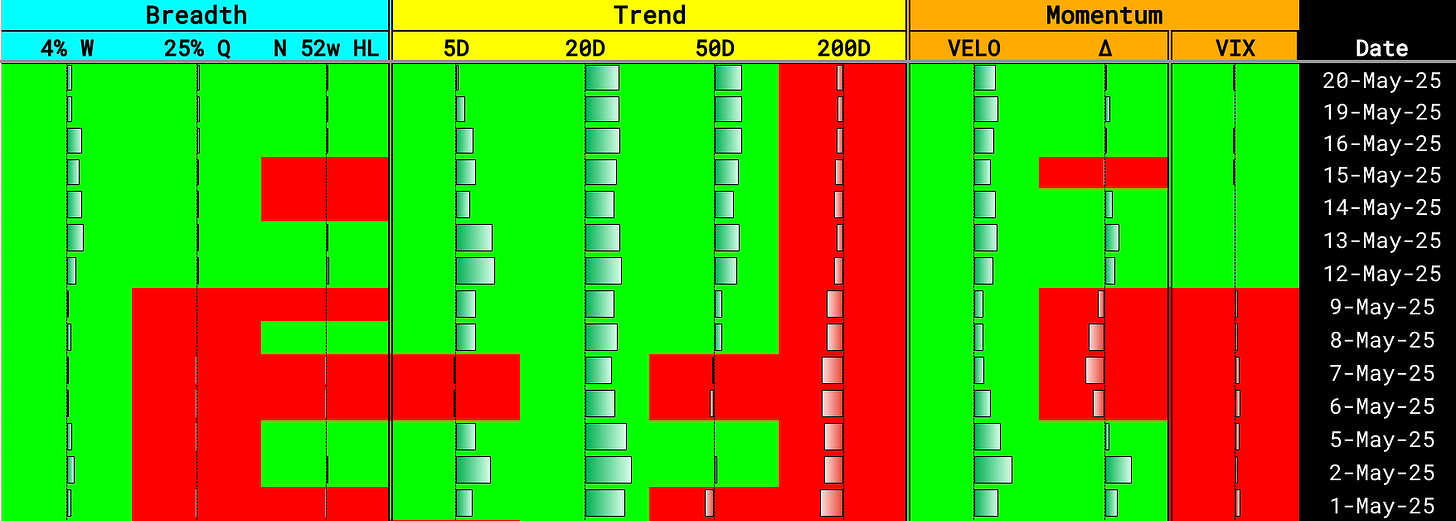

A proprietary model that evaluates the current state of the market using three core components — Trend, Breadth, and Momentum.

⦿ Trend → Bullish

Short- and medium-term trend signals remain firmly bullish. The 5-day, 20-day, and 50-day trends are all green, reflecting ongoing price strength. The 200-day trend is still negative, but this remains the only structural laggard in an otherwise strong trend environment.

Short-term (5D) → Positive

Medium-term (20D & 50D) → Positive

Long-term (200D) → Negative (yet to confirm)

⦿ Breadth → Expanding

Breadth continues to broaden meaningfully. The 4% weekly and 25% quarterly breadth readings remain green, and importantly, the 52-week New High/Low (NHL) reading has flipped positive again. This confirms wider market participation and breakout follow-through.

4% Week → Positive

25% Quarter → Positive

52w New High/Low (NHL) → Positive

⦿ Momentum → Reaccelerating

Momentum is showing renewed strength. Velocity is firmly positive and Delta has improved, suggesting acceleration in price movement. The VIX remains low and stable, reinforcing the market’s calm and bullish undertone.

Velocity → Positive and reaccelerating

Volatility (VIX) → Positive (low and stable)

Market structure is about as constructive as it gets: trends are aligned, breadth is expanding, and momentum is firming. While the long-term trend still lags, the near-term setup supports selective long exposure. Favor relative strength leaders, trail gains, and stay nimble — but right now, bulls have the edge.

🔍 Alpha List

The Alpha List is our free, high-quality watchlist highlighting stocks with breakout potential and strong technical momentum. Curated nightly using our proprietary model, it’s the first step in identifying elite opportunities.

→ View Today’s Alpha List (Free)

Broader Market Analysis

Despite today's softness in price action, the sector structure remains bullish under the hood. Trends are holding, momentum remains resilient, and leadership is rotating without major deterioration. Dips are being absorbed, and risk appetite is quietly supported by continued strength in crypto and select cyclicals. Monitor for follow-through in the next session — any strength from Tech (XLK) and Industrials (XLI) could set the tone.

Ready to Trade Smarter? Join BitResearch Premium

BitResearch isn’t just a stock alert service — it’s your edge in today’s market. With access to our live portfolio, you’ll receive expertly curated trade setups, complete with clear entry points, dynamic stop-losses, and two-stage profit targets.

Whether you're risk-averse or growth-focused, our menu of high-probability ideas is built to fit your strategy — all backed by a 14-factor technical model used by serious traders.

✅ Real trades. Real-time updates.

✅ BitReports with actionable insights

✅ No hype. No day trading. Just data-driven swing trades.

🎯 Start your 7-day free trial today and get instant access to the full portfolio, without obligation.

Let BitResearch simplify your trading — so you can focus on results.

Stay Connected — Follow BitResearch

Want even more insights, trade ideas, and market breakdowns?

📲 Follow us on Twitter/X

📬 Subscribe on YouTube for tutorials and portfolio updates

📣 Join our growing community of traders sharing strategies and results

At BitResearch, we’re building more than trades — we’re building smarter investors.