Market Triangle | 05.21.2025

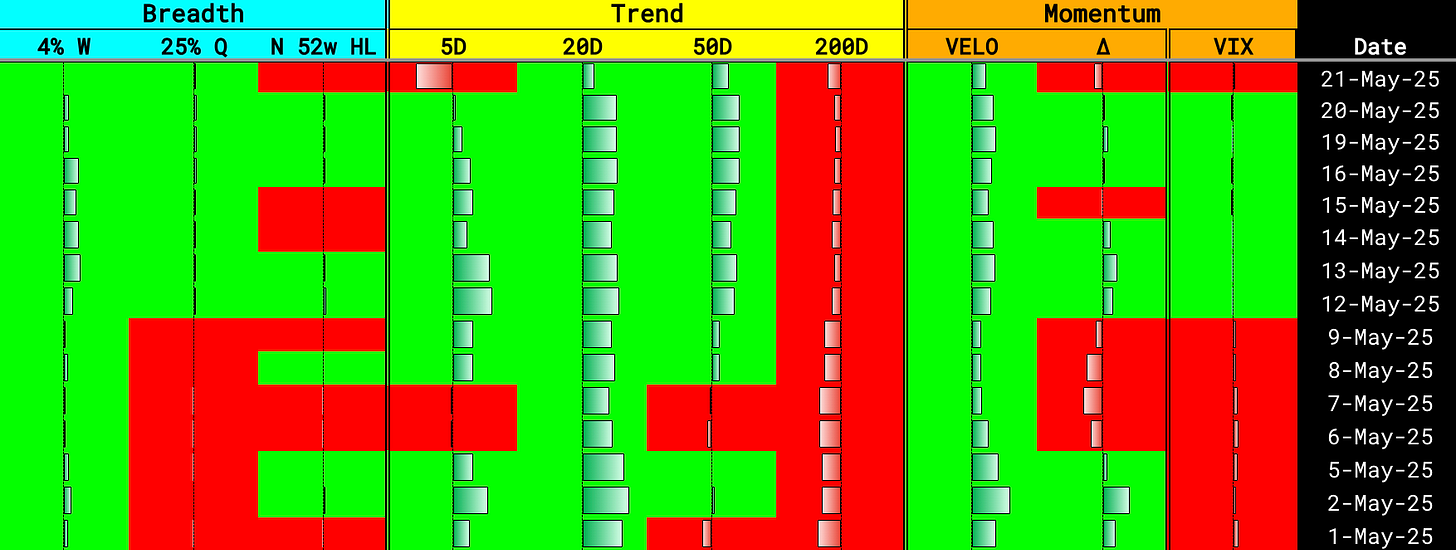

A proprietary model that evaluates the current state of the market using three core components — Trend, Breadth, and Momentum.

⦿ Trend → Reversing

Trend signals are deteriorating. The 5-day trend flipped red, while 20-day and 50-day trends are starting to fade, with 50D showing early weakness. The 200-day trend remains negative, reinforcing a growing divergence between short-term pressure and long-term weakness. Trend structure has lost its alignment — a clear caution flag.

Short-term (5D) → Negative

Medium-term (20D & 50D) → Turning Neutral

Long-term (200D) → Still Negative

⦿ Breadth → Weakening

Breadth is clearly rolling over. Fewer stocks are making significant weekly or quarterly moves, and the 52-week New High/Low reading flipped back to red — signaling contraction in breakout participation. This drop in breadth is a key signal that leadership is thinning.

4% Week → Positive

25% Quarter → Negative

52w New High/Low (NHL) → Negative

⦿ Momentum → Cooling

Momentum is slipping. Velocity remains positive but has slowed considerably, and Delta is weakening, reflecting fading acceleration. Most notably, VIX is starting to rise, a sign of elevated risk premium creeping back into the market. This marks a potential shift toward volatility expansion.

Velocity → Slowing

Volatility (VIX) → Rising

The market’s technical posture is showing early signs of breakdown. Trend, breadth, and momentum are no longer aligned, and internal strength is fading. While this isn't a full reversal yet, it’s a sharp enough shift to demand more caution. If deterioration continues, a larger pullback may develop. Reduce risk, tighten stops, and favor cash or defensive exposure while waiting for the structure to reset.

🔍 Alpha List

The Alpha List is our free, high-quality watchlist highlighting stocks with breakout potential and strong technical momentum. Curated nightly using our proprietary model, it’s the first step in identifying elite opportunities.

→ View Today’s Alpha List (Free)

Broader Market Analysis

Widespread Selling: All major sectors closed lower except for Bitcoin (IBIT), which gained +1.44% — suggesting a defensive move into non-equity alternatives.

Small- and Mid-Caps Hit Hard:

Russell 2000 (IWM): -2.81%, the weakest performer, showing risk aversion and weakness in breadth-sensitive areas.

MidCap 400 (MDY): -2.67%, confirming broad-based pressure outside of mega caps.

Cyclical Weakness:

Industrials (XLI): -1.69%

Financials (XLF): -2.05%

Technology (XLK): -1.88% — a sign of institutional de-risking across growth and value segments.

Defensive Sectors Offer No Shelter:

Utilities (XLU): -1.82%

Consumer Staples (XLP): -1.16% — both declined, indicating broad distribution.

Health Care (XLV): Largest sector loser at -2.32%, despite being a typical defensive play.

Trend Breakdown:

Several sectors fell below short-term trend levels (20SMA, 50SMA) — with XLV and XLU breaking trend support.

Trend momentum (M-IO) weakened across the board, especially in XLV (-1.95%).

Bitcoin Outperforms:

IBIT led with a +1.44% gain and remains the only sector near YTD highs.

Suggests capital rotation into crypto or inflation hedge trades.

Overall, today's action reflects a risk-off rotation with pressure across the board — a potential warning sign of deeper correction if support zones do not hold.

Ready to Trade Smarter? Join BitResearch Premium

BitResearch isn’t just a stock alert service — it’s your edge in today’s market. With access to our live portfolio, you’ll receive expertly curated trade setups, complete with clear entry points, dynamic stop-losses, and two-stage profit targets.

Whether you're risk-averse or growth-focused, our menu of high-probability ideas is built to fit your strategy — all backed by a 14-factor technical model used by serious traders.

✅ Real trades. Real-time updates.

✅ BitReports with actionable insights

✅ No hype. No day trading. Just data-driven swing trades.

🎯 Start your 7-day free trial today and get instant access to the full portfolio, without obligation.

Let BitResearch simplify your trading — so you can focus on results.

Stay Connected — Follow BitResearch

Want even more insights, trade ideas, and market breakdowns?

📲 Follow us on Twitter/X

📬 Subscribe on YouTube for tutorials and portfolio updates

📣 Join our growing community of traders sharing strategies and results

At BitResearch, we’re building more than trades — we’re building smarter investors.