Market Triangle | 06.10.2025

A proprietary model that evaluates the current state of the market using three core components — Trend, Breadth, and Momentum.

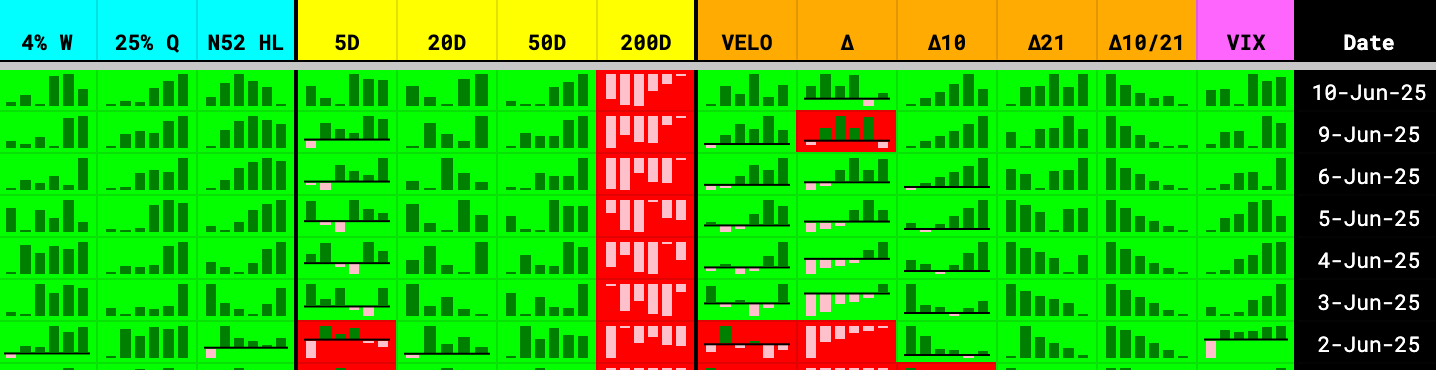

⦿ Trend → Gaining Strength

The trend structure is improving across all key timeframes. The 5-day trend has flipped green, and both the 20-day and 50-day trends remain strong, showing persistent buying pressure and sustained directionality. While the 200-day trend is still red, it’s beginning to strengthen, hinting at the early stages of a longer-term recovery.

Short-term (5D) → Positive

Medium-term (20D & 50D) → Strong and aligned

Long-term (200D) → Still Negative but improving

⦿ Breadth → Broad and Supportive

Breadth remains clearly constructive. All participation metrics — 4% Weekly Breadth, 25% Quarterly Breadth, and 52-week High/Low readings — are firmly green, showing broad market engagement. This suggests the rally is not narrow, but backed by strong internal leadership and healthy rotation.

4% Week → Positive

25% Quarter → Positive

52w New High/Low (NHL) → Positive

⦿ Momentum → Strong and Rising

Momentum has reignited. Velocity (VELO) is green, confirming stronger price action and faster movement across equities. Delta (Δ) is also rising, showing a pickup in acceleration, while VIX remains in decline, further easing volatility pressure. This marks an environment supportive of breakouts and risk-on behavior.

Velocity (VELO) → Positive

Delta (Δ) → Positive and strengthening

Volatility (VIX) → Falling

The market is shifting back into offense mode. With trend alignment improving, breadth holding firm, and momentum accelerating, conditions are turning increasingly favorable for upside continuation. While the 200-day trend still lags, it’s beginning to catch up — a potential signal that longer-term conviction is returning. Traders can lean into strength, focus on leadership sectors, and trail stops higher — but stay attentive to any sharp reversals or failed breakouts as we test new highs.

🔍 Alpha List

The Alpha List is our free, high-quality watchlist highlighting stocks with breakout potential and strong technical momentum. Curated nightly using our proprietary model, it’s the first step in identifying elite opportunities.

→ View Today’s Alpha List (Free)

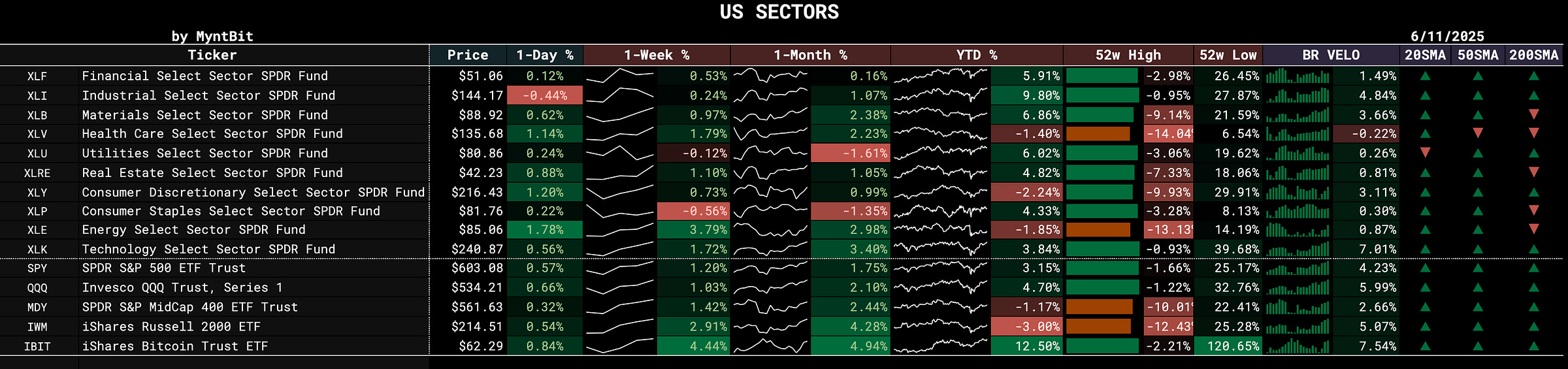

Broader Market Analysis

Stay overweight growth sectors (XLK, XLY, XLE) while trailing stops on extended names.

Watch IBIT for sentiment extremes — its breakout may signal broader risk-on confirmation.

Avoid chasing defensives like XLU/XLP unless they reclaim key moving averages.

Small caps (IWM) offer a tactical long opportunity with improving breadth and strong trend alignment.

Ready to Trade Smarter? Join BitResearch Premium

BitResearch isn’t just a stock alert service — it’s your edge in today’s market. With access to our live portfolio, you’ll receive expertly curated trade setups, complete with clear entry points, dynamic stop-losses, and two-stage profit targets.

Whether you're risk-averse or growth-focused, our menu of high-probability ideas is built to fit your strategy — all backed by a 14-factor technical model used by serious traders.

✅ Real trades. Real-time updates.

✅ BitReports with actionable insights

✅ No hype. No day trading. Just data-driven swing trades.

🎯 Start your 7-day free trial today and get instant access to the full portfolio, without obligation.

Let BitResearch simplify your trading — so you can focus on results.

Stay Connected — Follow BitResearch

Want even more insights, trade ideas, and market breakdowns?

📲 Follow us on Twitter/X

📬 Subscribe on YouTube for tutorials and portfolio updates

📣 Join our growing community of traders sharing strategies and results

At BitResearch, we’re building more than trades — we’re building smarter investors.