Momentum Meets Reality | Retail Giants, Tech Titans, and Rate Signals Ahead – Week of May 18

Dive into the market analysis for the upcoming week of May 18, 2025 and the week’s key economic data. Stay ahead with expert insights and forecasts.

Market Report

Major indices closed higher for the week, reclaiming year-to-date gains and extending their recovery from the April lows.

The S&P 500 rose 1.3%, and the Dow Jones Industrial Average added 0.3%, both turning positive on the year following broad-based strength fueled by improved trade sentiment and mega-cap tech leadership.

Macro & Geopolitical Highlights

U.S. and China reached a 90-day tariff rollback deal, reducing U.S. tariffs from 145% to 30% and China’s from 125% to 10% — deeper than expected.

The agreement lifted market sentiment but came with a caution: tariff relief expires in 90 days if no long-term deal is reached.

The announcement sparked a broad rally, amplified by short covering and FOMO, as traders chased strength across sectors.

Market expectations for a pullback were defied by continued resilience, especially in growth stocks and large-cap tech.

Index Snapshots

At its April 7 low, the S&P 500 was down 17.8% YTD and 21.4% off its all-time high.

As of Friday’s close, it is now +23.2% from the April low, sitting just 3.2% below ATHs.

Stock-Specific Moves

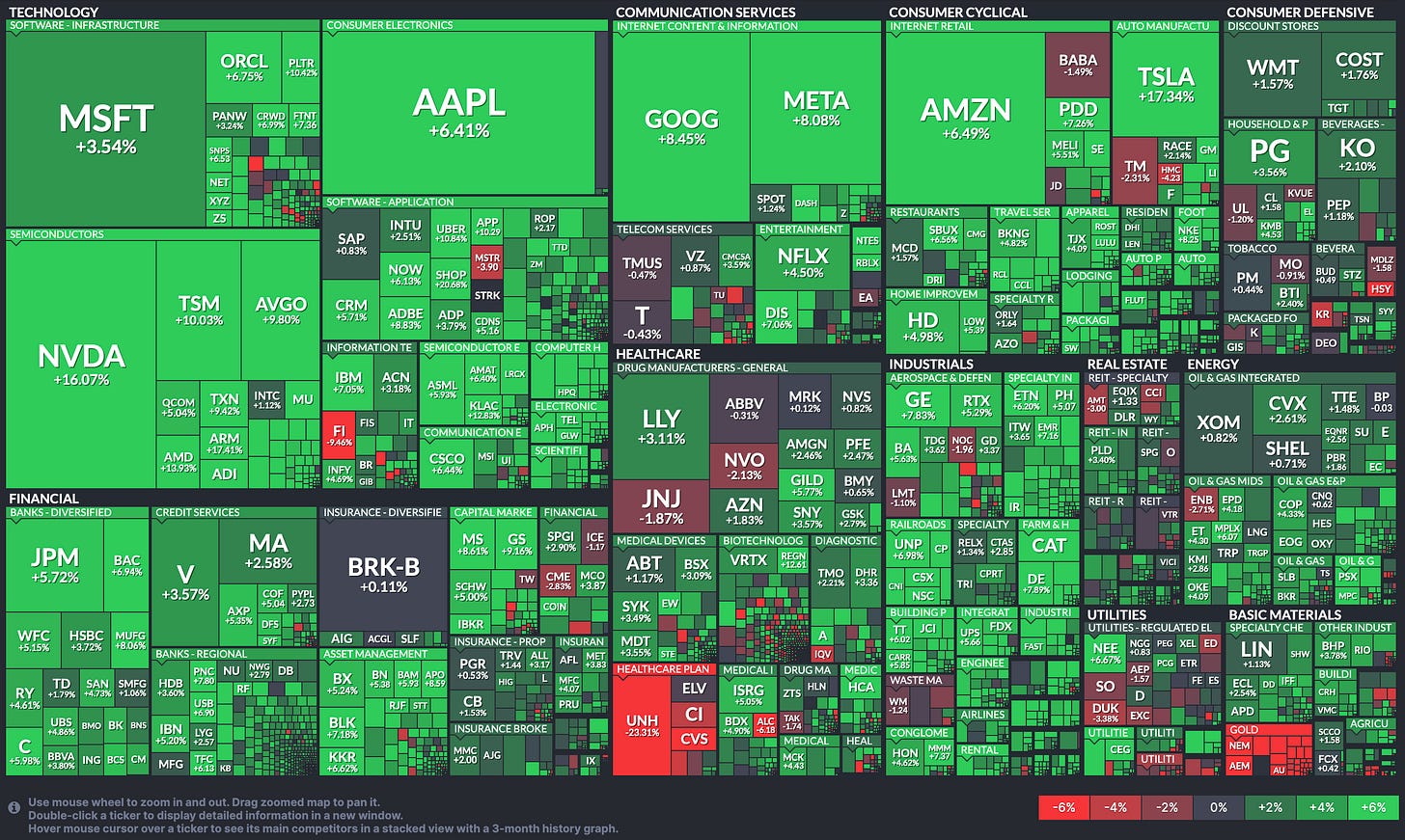

NVIDIA (NVDA) surged +16%, leading the semiconductor space.

Apple (AAPL) gained +6.4%, contributing to mega-cap outperformance.

Vanguard Mega Cap Growth ETF (MGK) jumped +7.2%, driven by tech momentum.

UnitedHealth (UNH) fell -23.3% after announcing its CEO’s resignation and suspending 2025 guidance due to rising medical costs.

Economic Data Recap

April CPI and PPI showed no inflation spike from tariffs, easing macro concerns.

Mixed economic prints included:

Retail Sales and Industrial Production

Jobless Claims (initial and continuing)

May Manufacturing Surveys: Philly Fed, Empire State, NAHB Index

Despite rising yields, stocks pushed higher:

10-Year Yield: rose to 4.44% (+6 bps)

2-Year Yield: rose to 3.98% (+10 bps)

Weekly Market Heatmap

Weekly Sector Performance

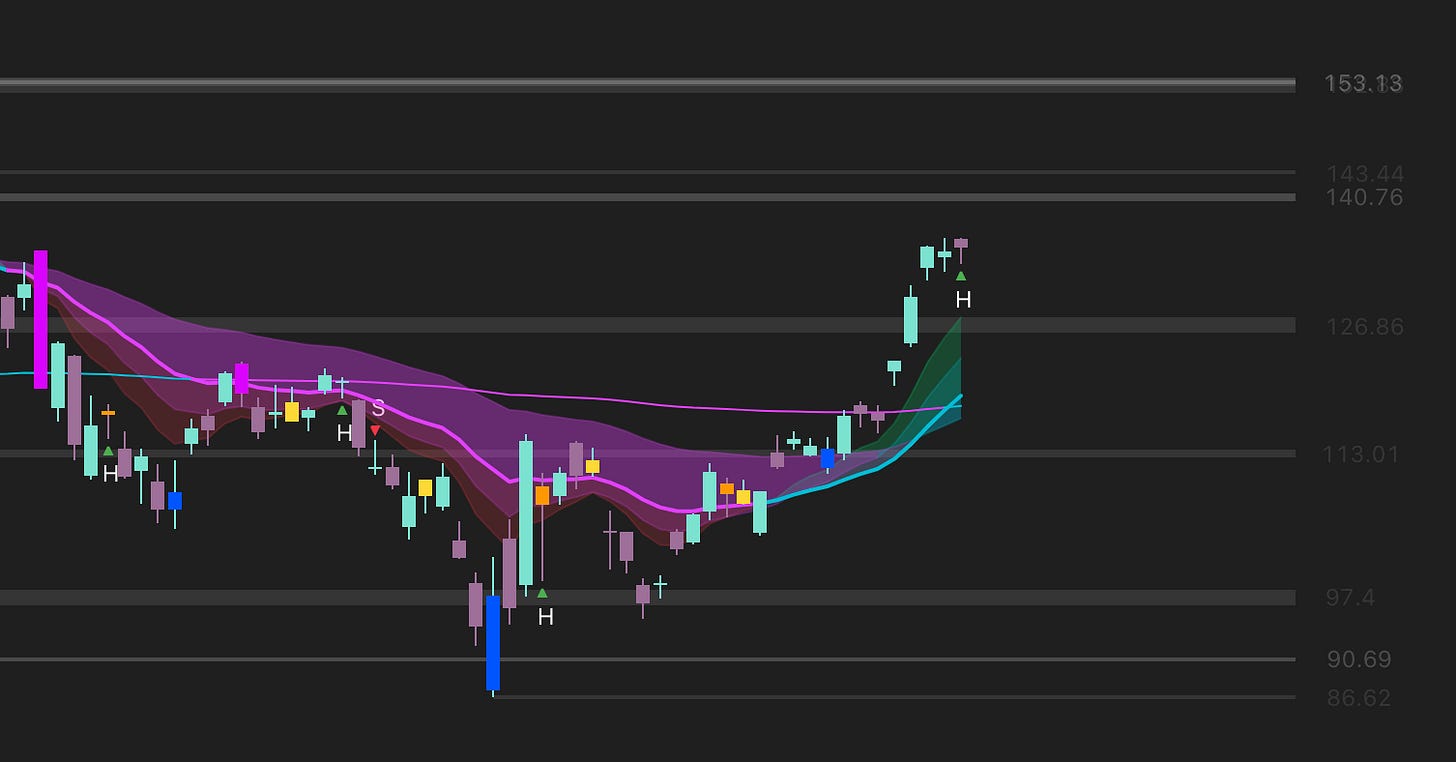

Market Triangle

⦿ Trend → Short- and medium-term trend signals remain firmly positive, supporting a continuation bias for bullish setups. The longer-term 200-day trend, however, is still neutral to negative, indicating that macro trend alignment is still incomplete.

Short-term (5D) → Positive

Medium-term (20D & 50D) → Positive

Long-term (200D) → Negative (sluggish to reverse)

⦿ Breadth → Breadth continues to improve, with strong participation across timeframes. Notably, 52-week New High/Low (NHL) flipped back to positive, showing that more stocks are participating in the upside with fresh breakouts, which is a constructive sign.

4% Week → Positive

25% Quarter → Positive

52w New High/Low (NHL) → Positive

⦿ Momentum → Momentum is building again. Velocity is no longer fading, with delta improving and indicating renewed acceleration in price action. Low and stable volatility (VIX) continues to provide a supportive backdrop for trend continuation.

Velocity → Positive and reaccelerating

Volatility (VIX) → Positive (low and steady)

This is one of the strongest market structures seen in recent weeks: price trends are aligned, breadth is expanding, and momentum is firming. While long-term trend confirmation still lags, the current setup favors selective long exposure and position building in high-quality names. Stay disciplined, manage risk, but lean into strength while the market structure holds.

Broader Market Analysis

Trend Confirmation: Nearly all sectors are now above their 20-, 50-, and 200-day SMAs, a rare and constructive alignment that supports further upside.

Broadening Participation: A mix of offensive and defensive sector strength suggests improving market confidence.

Momentum Rotation: Tech and discretionary remain in leadership mode, but utilities and staples show new interest, hinting at subtle risk management under the surface.

Caution Flags: Energy and small-caps continue to lag, needing rotation support to confirm a full risk-on cycle.

All four major U.S. equity ETFs — SPY, QQQ, IWM, and MDY — continue to build on their April recovery with constructive price action and rising trend structure. SPY and QQQ lead with clean uptrends and strong relative strength, while MDY is quietly emerging from a multi-month base, showing early breakout potential. IWM remains the weakest, still stuck below key resistance with lagging momentum. Volume remains stable in SPY and QQQ, but confirmation breakouts are still needed in IWM and MDY. The broader market remains technically firm, but continued selectivity is warranted as leadership remains concentrated.

Looking Ahead to the Upcoming Week

The week ahead is relatively quiet until Thursday, which brings a heavy lineup of key economic releases likely to influence market sentiment and rate expectations:

Thursday, May 22

8:30 AM ET: Unemployment Claims — A closely watched labor market indicator. Forecast is 227K, slightly down from the prior 229K. Markets will be looking for signs of cooling or resilience in jobless trends.

9:45 AM ET: Flash Manufacturing PMI — Forecast is 49.9 vs. prior 50.2. A print below 50 would indicate contraction in the manufacturing sector.

9:45 AM ET: Flash Services PMI — Forecast at 50.7 vs. previous 50.8. Services activity has remained resilient, but any dip below 50 could signal early weakness.

10:00 AM ET: Existing Home Sales — Expected to edge higher to 4.15M from 4.02M, suggesting a possible spring housing market rebound.

Friday, May 23

10:00 AM ET: New Home Sales — Forecast is 696K vs. 724K prior. A soft reading here could reflect tightening affordability amid high mortgage rates.

📌 Takeaway:

Thursday’s trio of labor, manufacturing, and services data will be key in shaping short-term Fed outlooks, while Friday’s housing data may add nuance to the consumer and interest rate narrative. Expect potential volatility around these releases.

Earnings Highlights:

A busy earnings calendar is ahead, featuring key reports from retail giants, semiconductor names, and software leaders that could influence sector trends and broader sentiment.

Monday, May 19

Before Open: ZIM Integrated Shipping

After Close: Trip.com (TCOM)

Tuesday, May 20

Before Open: Home Depot (HD), Bilibili (BILI)

After Close: Palo Alto Networks (PANW)

Wednesday, May 21

Before Open: Lowe’s (LOW), Baidu (BIDU), TJX Companies (TJX), Wix.com (WIX), Medtronic (MDT), XPeng (XPEV), iQIYI (IQ)

After Close: Snowflake (SNOW)

Thursday, May 22

Before Open: Analog Devices (ADI), TD Bank (TD), Williams-Sonoma (WSM), Nano-X Imaging (NNOX)

After Close: Intuit (INTU), Workday (WDAY), Autodesk (ADSK), Copart (CPRT)

Friday, May 23

No earnings scheduled

📌 Takeaway

Retail and tech will be under the spotlight, with Home Depot, Lowe’s, and TJX offering insight into consumer strength, while software giants like Intuit and Snowflake will shape the tone for growth stocks. Watch semiconductor ADI mid-week for macro-sensitive guidance.

Stay Ahead with BitResearch Premium

Looking for a guided approach to earnings season?

Our Premium Portfolio features:

Real-time entries and exits

Dynamic stop-loss levels

Predefined targets and risk ratings

Unlock Your Edge with the BitResearch Indicator Suite

Powered by MyntBit, our exclusive tools decode market structure, volume signals, trend alignment, and relative strength — all in one view.

Includes access to:

OmniTrend, IntelVolume, PivotGrid, and more

Weekly updates and walkthroughs

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.

Ready to Trade Smarter? Join BitResearch Premium

BitResearch isn’t just a stock alert service — it’s your edge in today’s market. With access to our live portfolio, you’ll receive expertly curated trade setups, complete with clear entry points, dynamic stop-losses, and two-stage profit targets.

Whether you're risk-averse or growth-focused, our menu of high-probability ideas is built to fit your strategy — all backed by a 14-factor technical model used by serious traders.

✅ Real trades. Real-time updates.

✅ BitReports with actionable insights

✅ No hype. No day trading. Just data-driven swing trades.

🎯 Start your 7-day free trial today and get instant access to the full portfolio, without obligation.

Let BitResearch simplify your trading — so you can focus on results.

Stay Connected — Follow BitResearch

Want even more insights, trade ideas, and market breakdowns?

📲 Follow us on Twitter/X

📬 Subscribe on YouTube for tutorials and portfolio updates

📣 Join our growing community of traders sharing strategies and results

At BitResearch, we’re building more than trades — we’re building smarter investors

Outperform the market. Simplify your strategy. Let BitResearch work for you.